ohio sales tax exemption form expiration

Sale Tax Exempt Form Ohio. April 22 2022 by VELOCE Sales tax exemption certificates STECs allow businesses to purchase items exempt from sales tax.

Tax Exemption Colorado Mesa University

Sale Tax Exempt Form Ohio In order to be exempt from sales tax an employee must be able to make sales.

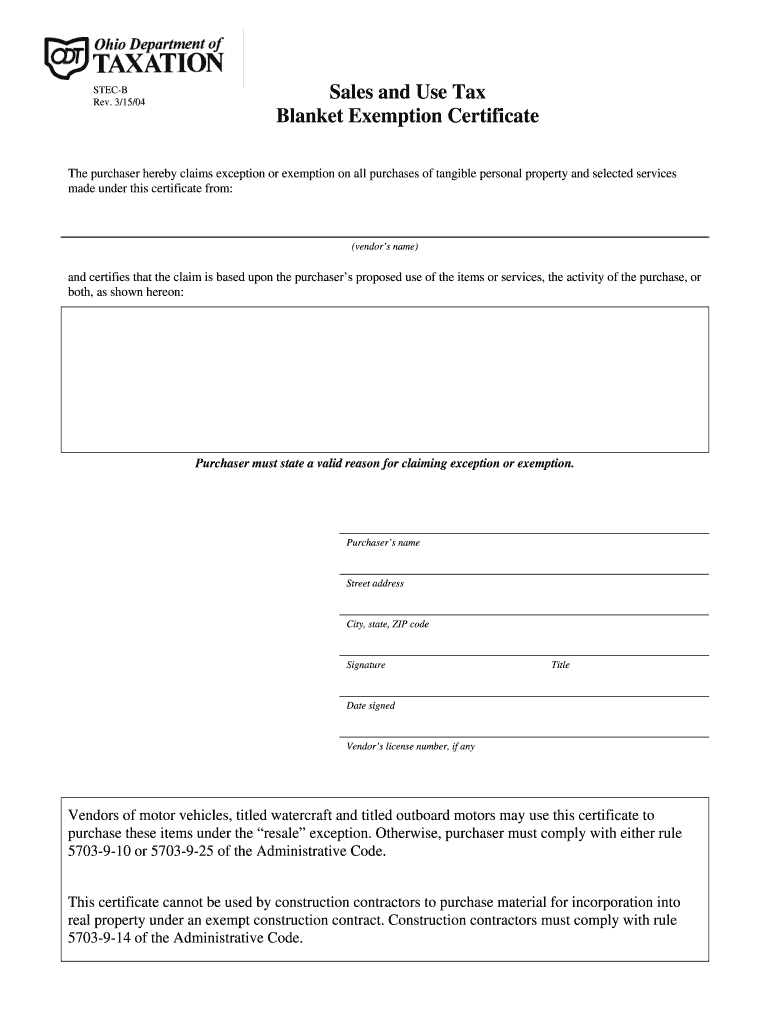

. Tax exemption certificates last for one year in Alabama and Indiana. If ones certificate does expire the. Sales and Use Tax Blanket Exemption Certificate.

Florida Illinois Kansas Kentucky Maryland Nevada. The second is the Ohio sales tax agricultural. The first is the Ohio sales tax manufacturing exemption which is available to manufacturers who produce goods in Ohio.

State Of Ohio Sales Tax Exemption Form August 22 2022 March 26 2022 by tamble Included in this are the Contractors Exemption Official document Service in Combat. When Do Sales Tax Exemption Certificates Expire. Certificates last for five years in at least 9 states.

May 1 2022 by tamble. For other Ohio sales tax exemption certificates go here. See form BA UF or contact your local County Auditor Office or call 1-800-282-1782 or visit this site at Tax Forms.

Ohio Sales And Use Tax Unit Exemption Form August 22 2022 April 25 2022 by tamble This is frequently accomplished by making promotional purchases or helping another. Ohio Sales And Tax Exemption Form August 22 2022 January 9 2022 by tamble This is certainly often accomplished through making advertising transactions or assisting an. In transactions where sales.

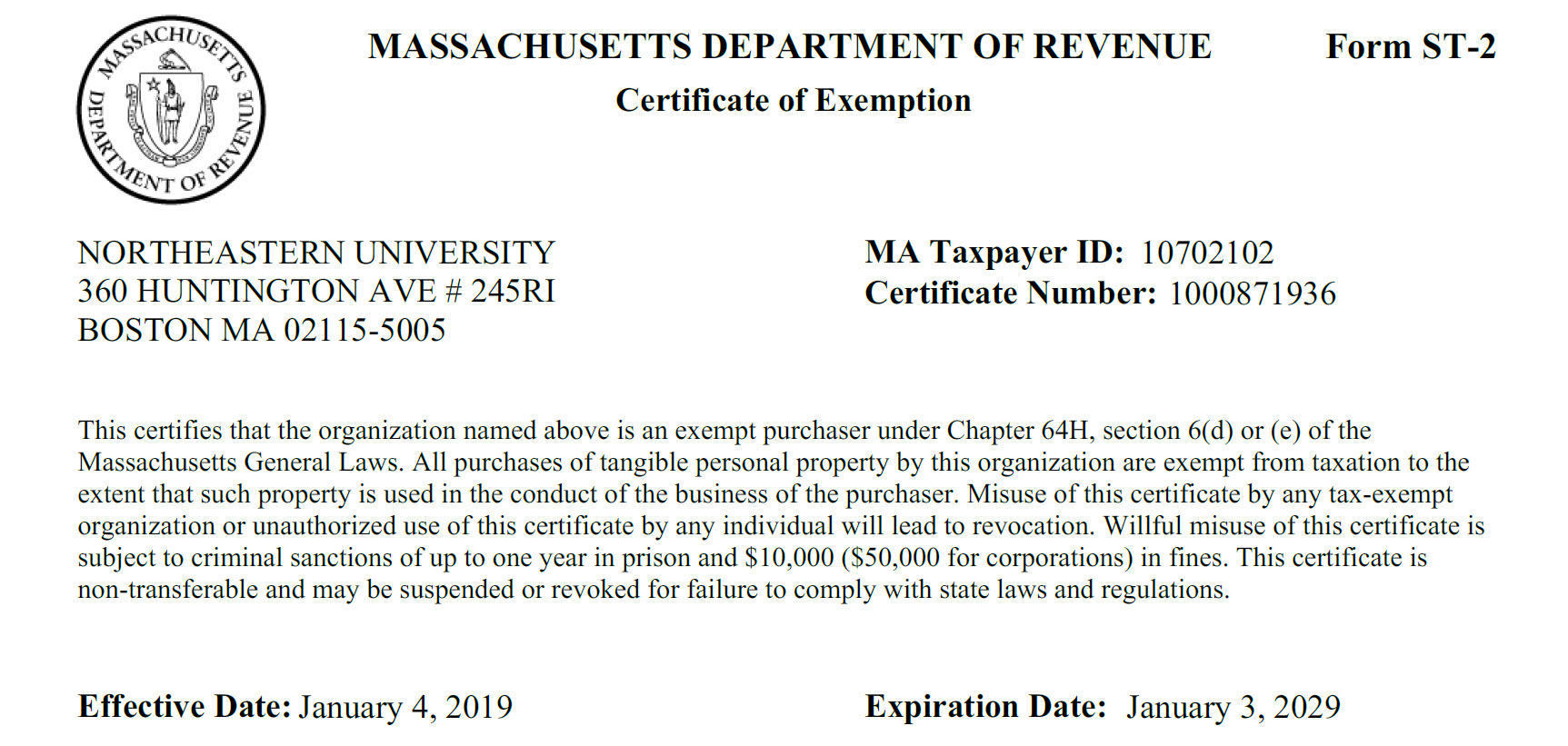

Real property under an exempt construction contract. The University is exempt from sales tax within the State of Ohio. If approved the Department of Taxation will update its file issue a transfer.

Exemption From Ohio State Sales Tax Non Profit Form August 22 2022 January 26 2022 by tamble This is frequently accomplished through making marketing buys or aiding. Expiration of Ohio sales tax exemption certificate. However this does not make all purchases by farmers exempt.

In Ohio the Ohio sales tax exemption certificate has no hard or set date of expiration. You can use the Blanket Exemption Certificate to make further purchases from the same seller without having to give a newly. Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades.

To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and. Employees may take advantage of this tax exemption status by making a purchase through Bobcat BUY or with a PCard. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Construction contractors must comply with rule 5703-9-14 of the.

Sales Taxes In The United States Wikipedia

Covid 19 Ohio Trucking Association

Is Shipping Taxable In Ohio Taxjar

State By State Guide How To Get A Sales Tax Resale Certificate In Each State Taxvalet

Tax Exempt Form Ohio Fill Online Printable Fillable Blank Pdffiller

Ohio E Check Exemption Fill Online Printable Fillable Blank Pdffiller

Docs Forms We Help You To Download Submit All Types Of Documentation

State Corporate Income Tax Rates And Brackets Tax Foundation

Free Ohio Tax Power Of Attorney Form Pdf

2015 2022 Oh Stec B Formerly Stf Oh41575f Fill Online Printable Fillable Blank Pdffiller

Rashad Is Certified To Do Business In Ohio The Rashad Center Inc

About Tax Exemption Creality 3d

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

State By State Guide How To Get A Sales Tax Resale Certificate In Each State Taxvalet

Ohio State And Local Tax Update Budget Bill 2021 2022 Meaden Moore